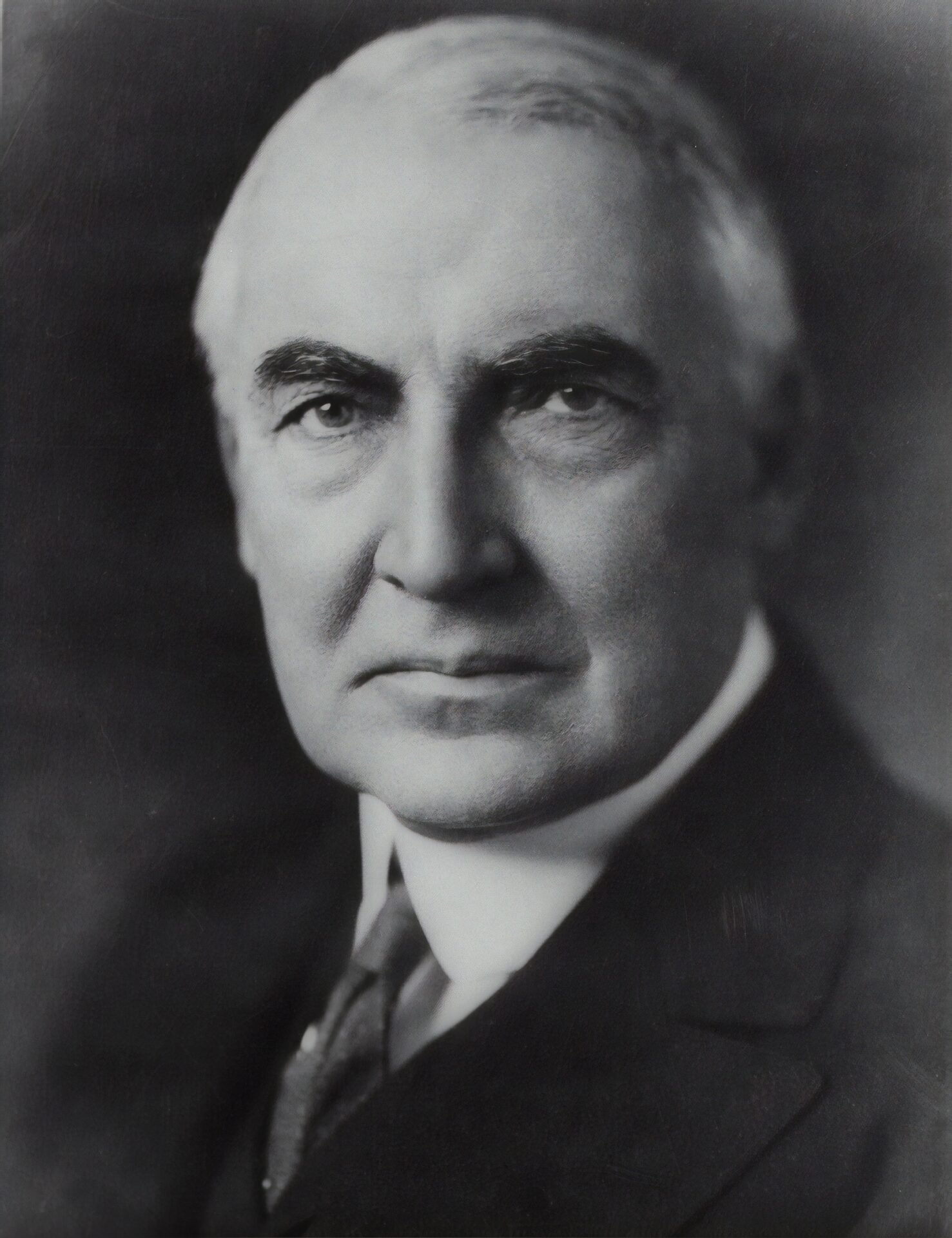

Warren Buffet, widely regarded as one of the most successful investors of all time, has built his fortune through a disciplined and patient approach to trading. With a net worth exceeding $100 billion, Buffet’s investment strategies have made him a household name and a source of inspiration for many aspiring investors.

Buffet’s trading philosophy is centered around long-term value investing. He focuses on buying undervalued companies with strong fundamentals and holding onto them for the long haul. This approach has earned him the nickname “The Oracle of Omaha” and has consistently delivered impressive returns over the years.

One of Buffet’s most well-known investments is his acquisition of Berkshire Hathaway, a struggling textile company, in the 1960s. Instead of liquidating the company, Buffet transformed it into a diversified conglomerate, investing in various industries such as insurance, utilities, and retail. Today, Berkshire Hathaway is one of the largest and most successful companies in the world, thanks to Buffet’s strategic vision.

Buffet’s success can be attributed to his ability to identify companies with a durable competitive advantage, also known as a moat. He looks for businesses that have a unique position in the market, making it difficult for competitors to replicate their success. This moat can come in the form of a strong brand, a proprietary technology, or high barriers to entry. By investing in companies with a sustainable competitive advantage, Buffet ensures long-term profitability.

Another key aspect of Buffet’s trading strategy is his emphasis on understanding the businesses he invests in. He believes in thoroughly researching a company’s financials, management team, and industry dynamics before making any investment decisions. This approach allows him to make informed choices and avoid impulsive trading based on short-term market trends.

Buffet is also known for his aversion to speculative investments and complex financial instruments. He prefers to invest in companies that he understands and can predict their future cash flows with a reasonable degree of certainty. This conservative approach has helped him avoid unnecessary risks and preserve capital.

Despite his immense success, Buffet remains humble and down-to-earth. He is known for his frugal lifestyle, living in the same modest house he bought in the 1950s and driving an ordinary car. Buffet’s focus on long-term wealth creation rather than short-term extravagance is a testament to his disciplined approach to trading.

Over the years, Buffet has also become a prominent philanthropist. In 2006, he pledged to donate 99% of his wealth to charitable causes, primarily through the Bill and Melinda Gates Foundation. Buffet’s commitment to giving back and making a positive impact on society further highlights his values and principles.

In conclusion, Warren Buffet’s trading success can be attributed to his long-term value investing approach, focus on companies with a durable competitive advantage, thorough research, and aversion to speculative investments. His disciplined and patient approach has allowed him to consistently generate impressive returns and build a vast fortune. Buffet’s story serves as an inspiration for investors around the world, showcasing the power of a well-thought-out trading strategy and a steadfast commitment to long-term wealth creation.

Be First to Comment